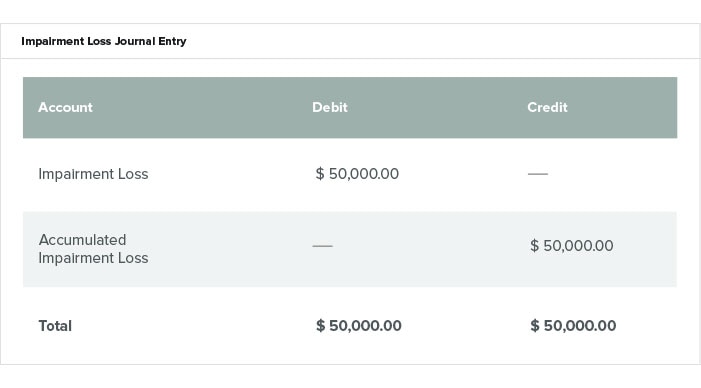

Impairment Loss Journal Entry

Impairment majorly constitutes a reduction in the value of an. Thus the total impairment loss amounts to 1250000.

Fixed Asset Accounting Made Simple Netsuite

The estimated recoverable amount of the machine is now 120000 the depreciation that would be charged for the asset this financial year is 16000.

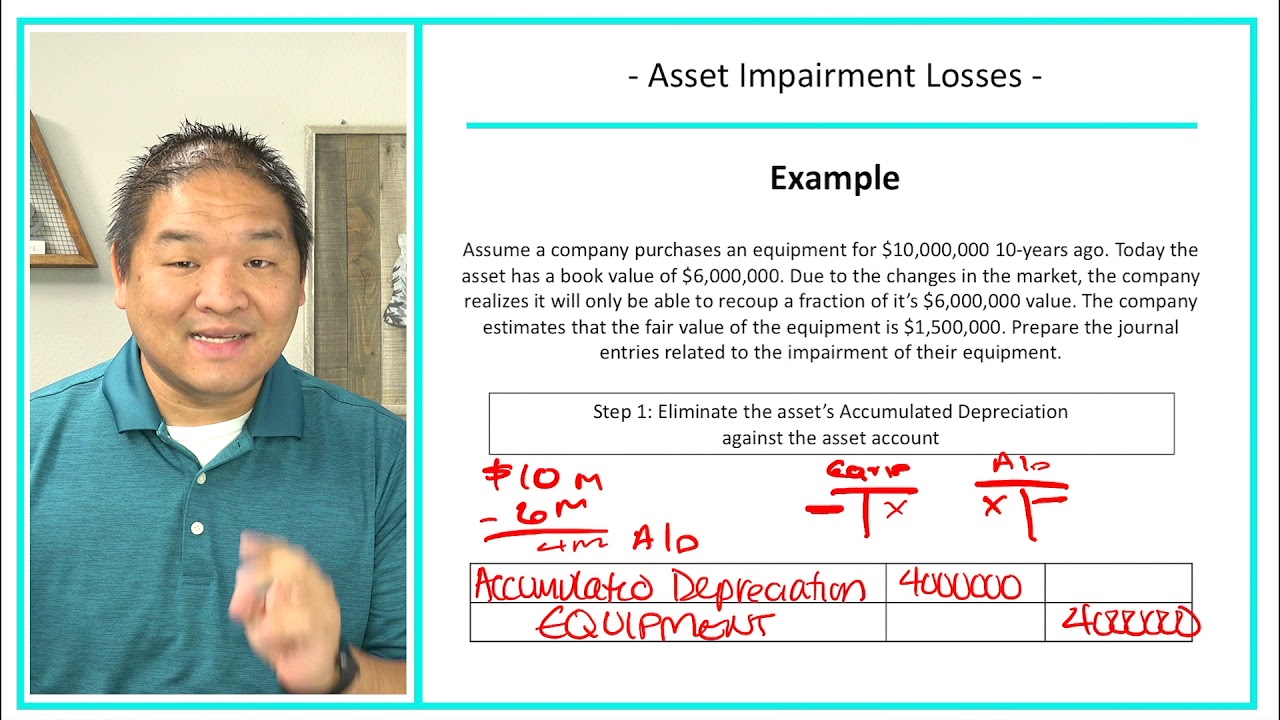

. Following an impairment loss subsequent depreciation charge is adjusted to reflect lower carrying amount IAS 3663. So we need to reduce the balance of fixed assets. This is an impairment loss.

The journal entry above shows the write-off of an asset from the Balance Sheet. Record journal entries for recognizing impairment loss in the following two scenarios. As mentioned the accumulated impairment loss is the contra asset account to reduce the assets value.

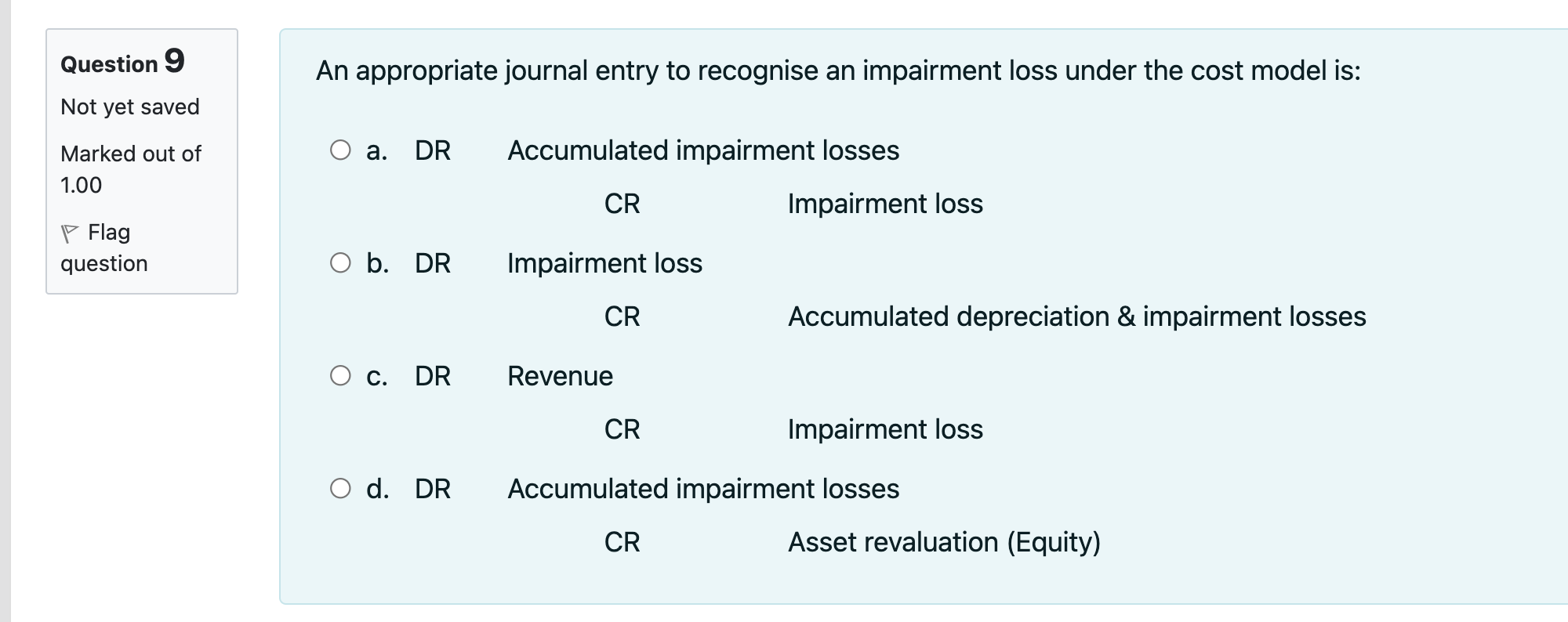

This account holds all the impairment. Asset is carried at revaluation model and there is a. Dr Impairment losses ac PL account Cr Asset.

The journal entry would be. The total carrying value for the CGU is 2600000 and the total estimated recoverable amount is 1350000. However before recording the impairment loss a company must first determine the recoverable value of the asset.

Company ABC Limited has identified an impairment loss of 300000 on one of its land which will not be recovered shortly soon. In this journal entry the goodwill which is an intangible asset on the balance sheet of the company ABC will be reduced. Please record the journal entry of impairment loss.

Based on the report from a technical expert the impairment loss is 50 million. Overall companies can record impairment loss journal entries as follows. Accounting Treatment for Impairment.

An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower. The journal entry to record impairment is straightforward. Journal entry for recording the impairment is the debit to the loss account or to expense account with the corresponding credit to an underlying asset.

Here is an example of goodwill impairment and its impact on the balance sheet income statement and cash flow statement. The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000. Company BB acquires the assets of company CC.

The land cost 400000 two years ago. The amount of the. In this case the company ABC needs to make the fixed asset impairment journal entry for the impairment loss of 50000 due to obsolescence of its machine as below.

Impairment loss is recognized immediately in PL unless the asset is carried at revalued amount Thus entries would be. Asset is carried at cost model. Reversal of impairment loss.

On top of that the presentation and disclosures also vary. If due to any event the impaired.

Financial Accounting Lesson 9 11 Asset Impairment Losses Youtube

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

No comments for "Impairment Loss Journal Entry"

Post a Comment